ELECTRICITY BILL

Understanding your bill, now easier than ever

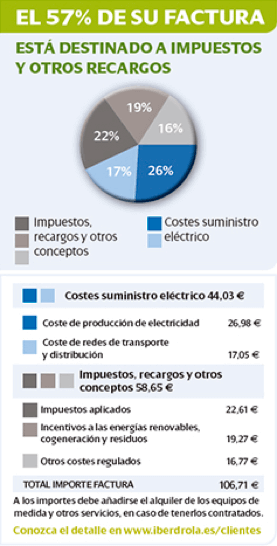

Destination of billed amount

Only part of the amount on your bill is for covering electricity supply costs(*). The remainder is for paying a series of taxes and other regulated costs included in current legislation.

Supply costs

- Electricity production costs and retail margin: earmarked for the production and sale of electricity.

- Costs of transmission and distribution networks: required to bring electricity to your home and so that you can use it.

Taxes

- Electricity tax: one of the so-called special taxes, such as those applied to alcohol, tobacco and hydrocarbons. It is calculated as established by current legislation, multiplying what you pay for electricity consumption and contracted power by 1.05113. A percentage of 4.864% is applied to the result.

- VAT (Value Added Tax): The current rate is applied to the sum of all the items billed, including electricity tax. In the case of the Canaries, IGIC will be applied at the current rate and in the case of Ceuta and Melilla, IPSI at the current rate.

Other regulated costs

- Incentives for renewable energies, cogeneration and waste.

- Payments to the System Operator and the Market Operator as compensation for these operators.

- Payments due to system capacity depending on rate periods.

- The amounts that result from applying losses.

(*) Only part of the amount on your bill is for covering electricity supply costs(*). The remainder is for paying a series of taxes and other regulated costs included in current legislation.